1. Market Overview

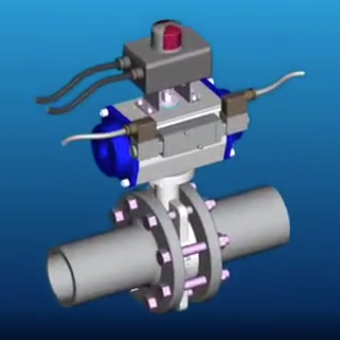

The Chinese pneumatic actuator industry continues to dominate global supply chains, with competitive pricing driven by localized production and economies of scale. Key manufacturing hubs include Zhejiang, Shanghai, and Fujian, where joint ventures like WUXI XINMING AUTO-CONTROL VALVES INDUSTRY CO., LTD enhance technical capabilities.

2. 2025 Price Benchmarking

-

Standard Models:

- Double-acting pneumatic rotary actuators (e.g., AT150 series): 500 (with ISO 5211 mounting pads)

- Explosion-proof actuators for chemical plants: 3,000 (varies by torque and certification)

-

Customized Solutions:

- Sanitary-grade actuators with tri-clamp connections: 1,200 (food/pharma applications)

- Integrated manual override (IMO) models: 20–30% premium over base prices

3. Competitive Landscape

Leading manufacturers like UNIWO and MAIYUE ACTUATOR offer bulk discounts (e.g., 10% for 50+ units), while SMEs in Yongjia County provide budget options under $200. European collaborations (e.g., AIR-TEC) introduce higher-precision actuators at 15–25% cost premiums.

4. Procurement Strategies

- Direct Sourcing: Alibaba 1688 remains a primary platform for real-time quotes, with 50% of suppliers offering MOQs ≤10 units1.

- OEM Services: Custom branding and packaging add 5–10% to base costs.

5. Future Outlook

Tariff policies and raw material fluctuations may impact Q3 2025 pricing, though China’s 80% domestic component sourcing mitigates risks. Buyers are advised to lock contracts before peak demand seasons (e.g., September–November).

If you want to learn more about low-priced products, please visit the following website: www.xm-valveactuator.com